Keeping merchants & consumers safe by protecting online transactions

from hacking, fraud and unauthorized card payments.

Protect your business with a safer and simpler payment solution. Reduce product losses & charge back fees. With Securter App Launch stage, customers will be verified and their payments details will not be intercepted by bad actors, during transaction transmission, protecting them and your business.

In upcoming releases, scheduled for Q1 2023, online buyers will be able to use their smartphones to read their EMV chip cards on credit and debit cards, making eCommerce transactions as safe as in person purchases. Turning transactions into Card Present.

Register your business with Securter for free to get started. Generate a QR code for purchasers to use with their apps. We will help you take care of the technical set up details.

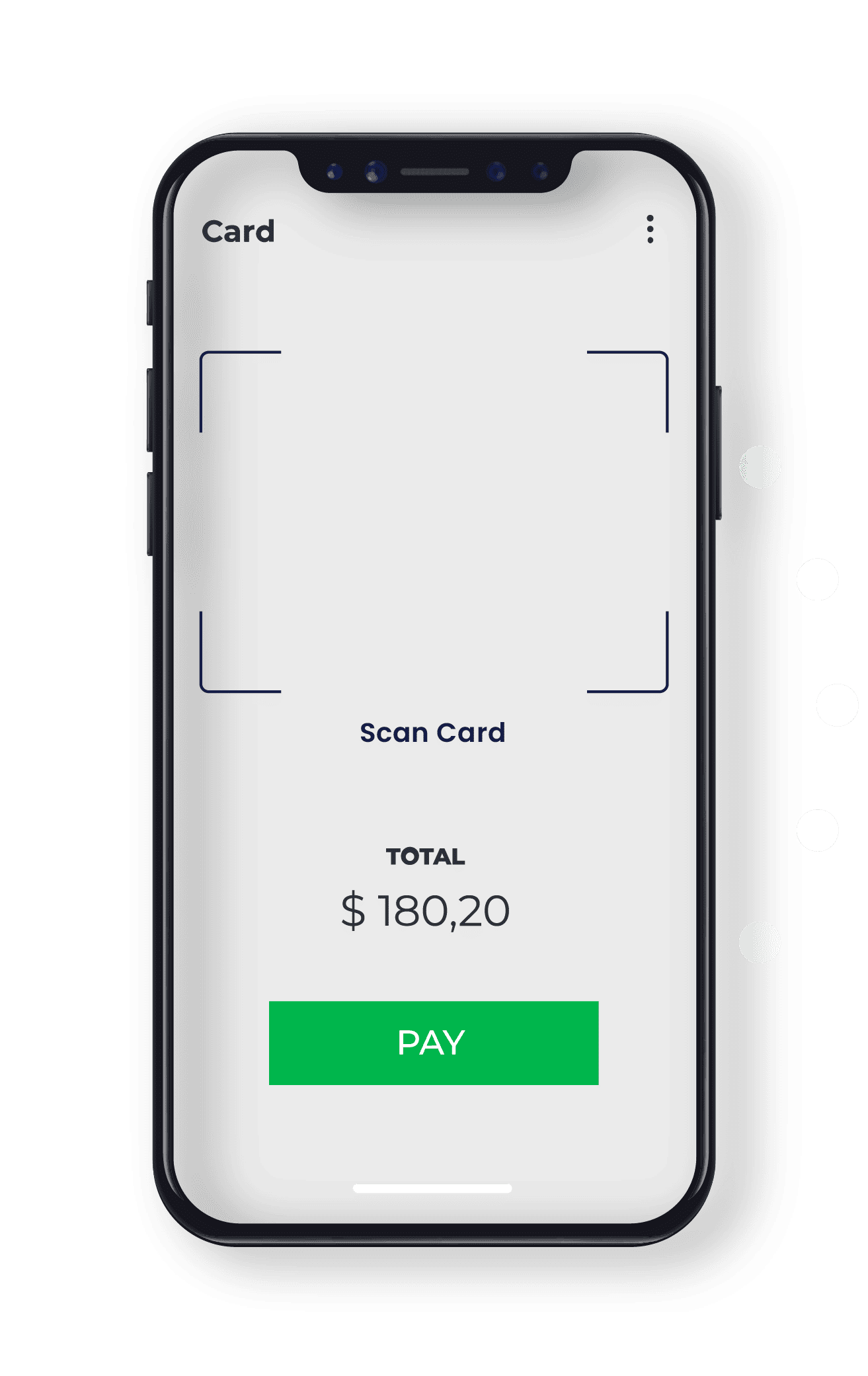

Customers check out in-store using Securter by scanning your QR code and their payment cards on a phone. No credit card details are exchanged or stored.

Rest assured that all payments are secure and that your income is protected. No more lost revenue with charge backs & lost products.

Increase sales by reducing cart abandonment due to customers uncomfortable to give credit card details on a site they may not know or trust.

Eliminate data intercept points for hackers and fraudsters. Card data is encrypted and never stored.

Once you become a member of the Securter family of Merchants we will even help set up your new payment option on your website.

A new convenient, quicker and more secure alternative to vulnerable credit card number input systems.

Identity and payment details theft is on the rise. Securter has developed a patent pending enhanced security protocol which will protect your credit and debit card payment details from bad actors whether you shop in person or online.

Your card and personal details will never be shared with the Merchant reducing the chances of your cards and identity to be stolen and misused.

Billions of dollars are lost to credit card fraud annually, hurting consumers and businesses.

Credit card details are lost primarily through merchants’ website and server hacks and spyware with key loggers installed on consumer devices. Consumer identity and card details are the most frequently sold commodity on the Dark Web.

By eliminating manual credit card entry, we safeguard online transactions from hacking, fraud and unauthorized card payments to keep merchants and consumers secure.

* Source: 2020, Nielsen

Securter’s technology allows for credit cards to be photographed, their numerical data digitized and sent securely to the merchant.

An upcoming patent pending release will allow for most card holders’ smart phones to be turned into EMV chip reader terminals making online transactions virtually the same as doing them in person.

Securter verifies buyer identity when signing app through the most advanced biometric technology available, far exceeding current industry standards.

Once confirmed , your eCommerce buyers will soon have their own chip card verification devices in their pockets making the transaction as secure as if it was done in person.

Help your customers pay using Securter’. Advertise the Securter logo and QR code in your online store to keep you and your clients assured of an elevated level of payment safety.