Smarter Fraud Prevention for Online Merchants

Reduce chargebacks, eliminate false declines, and boost revenue with AI-powered orchestration and EMV Tap & PIN for e-commerce.

Explore Our PlansThe Challenges Online Merchants Face

Online merchants are trapped in a constant, impossible tradeoff between stopping fraud and accepting legitimate sales.

LOST REVENUE

(False Declines)

($443B total annual losses worldwide 2024)

Legitimate customers incorrectly flagged as fraudulent — every false decline is a lost sale

LOST REVENUE

Card Not Present FRAUD

($44.3B total annual fraud losses worldwide 2024)

Fraud cases lead to chargeback fees, lost inventory, and operational costs

HIGH COSTS

Anti-Fraud Tools

(AI fraud scoring)

(3DS2)

Complex tools create tech headaches and drive up costs

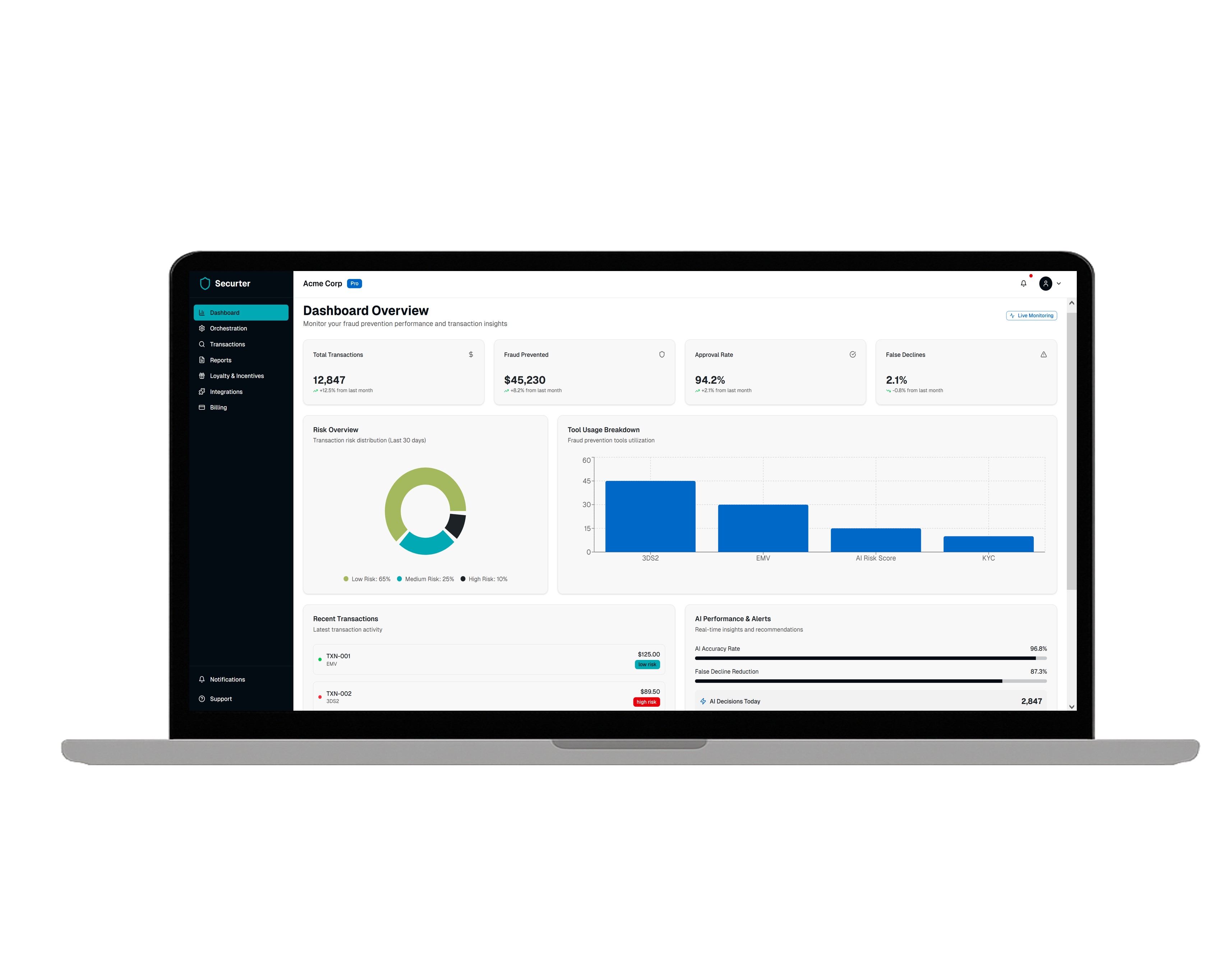

How Securter Works

Securter provides a U.S.-patented (2025) mobile app and no-code platform that enable merchants to intelligently route transactions and manage payment security from a single, simple dashboard.

Patented EMV 'Tap & PIN'

Bank-grade, 'card present-like' authentication for online purchases

No-Code Rule Builder

Automate smart rules for high-risk transactions without coding

3-Layer Smart Orchestration

EMV, 3DS2, and AI work together for optimal routing

Real-Time Dashboard

Monitor all transactions and security metrics in one place

Proven Results for Your Business

Securter delivers measurable value by solving the impossible tradeoff between fraud prevention and revenue growth

RECOVERED REVENUE

(False Declines)

Revenue Recovery

Accept legitimate transactions that would have been incorrectly declined — capture lost sales and grow revenue

REDUCED CNP FRAUD

(Chargebacks)

Chargeback Reduction

Stop fraudulent transactions before they happen — eliminate chargeback fees, lost inventory, and operational costs

REDUCED COSTS

(Anti-Fraud Platform)

Cost Savings

Replace expensive, complex fraud tools with one intelligent platform — reduce security costs while improving performance

The Securter Advantage: Enhancing Your Wallet Integration

Digital wallets like Apple Pay and Google Pay are essential payment methods. Securter enhances these wallets by adding an extra layer of security and intelligence, helping you maximize their value while minimizing complexity.

Common Challenges with Standard Wallet Integration

Technical Complexity

Ongoing Maintenance

- Ongoing management of cryptographic keys & certificates

- Multiple APIs to coordinate (Apple, Google, Samsung)

- Configuration updates can affect domain verification

Browser-Level Security Considerations

Protection Beyond the Wallet

- Browser-based transactions can be vulnerable to advanced malware

- Transaction manipulation risks at the browser level

- Additional security layers provide extra protection

Approval Optimization Opportunity

Enhancing Transaction Approval

- Banks use risk-based authentication that may decline legitimate purchases

- High-value or unusual transactions often require additional verification

- Stronger authentication can improve approval rates

How Securter Enhances Your Wallet Payments

The "Security Lock"

Stopping Fraud in Its Tracks

- Unique Transaction ID cryptographically bound to payment token

- Mathematical seal breaks if hacker tries to redirect payment

- "What You See Is What You Sign" guaranteed

One Integration, Total Peace of Mind

Zero Maintenance

- Install Securter Widget once — we handle all wallet connections

- Universal flow for desktop (QR) and mobile (button)

- We manage updates, certificates, and compliance changes

Why Upgrade to Securter?

| Feature | Standard Direct Integration | Securter Patented Flow |

|---|---|---|

| Integration Effort | High: Multiple APIs to maintain | Low: One widget does it all |

| Security | Vulnerable: Exposed to browser malware | Bulletproof: "Security Lock" prevents tampering |

| Approval Rates | Lower: Banks guess and decline valid sales | Highest: Definite proof boosts approvals |

| Maintenance | Constant: Manual certificate updates | None: Fully managed by Securter |

Securter transforms digital wallets from a simple payment method into a powerful engine for security, revenue growth, and operational efficiency.

Seamless Integration

Plug-and-play with your existing payment infrastructure

Flexible Pricing Plans

Choose the plan that fits your business needs

Platform Plans - Your Control Center

Small businesses & new merchants

Growing stores with 10K+ txns/month

Multi-channel or higher risk merchants

Transaction-Based Pricing - Pay-As-You-Go

| Feature | Cost (USD) | When It Applies |

|---|---|---|

| EMV(For Ecommerce) + AI + 3DS2 (Standard Flow) | $0.15 per txn | Default secure flow for most purchases |

| Micropayment Option | 0.30% of txn | For purchases under $50 |

| KYC Identity Verification | $2.00 per check | Triggered on high-value txns (> $10K) or merchant rule |

EMV Tap & PIN gives your customers a card-present experience online — no typing, no skimming, no phishing.

You're In Control

Inside your Securter dashboard, you can:

Set transaction thresholds for KYC

Customize when identity verification is triggered

Customize risk triggers

Define your own fraud detection rules

Track authentication flow

Monitor each customer journey in real-time

Instantly see fraud scores

Get immediate insights and decline reasons

Why Merchants Choose Securter

Reduce chargebacks and false declines

Gain control over your checkout security

Plug-and-play — no complex integrations

Only pay for what you actually use

Ready to Get Started?

Start with the Starter Plan for just $49/month — or contact us to tailor a solution that fits your needs.